.png)

Investing is one of the most effective ways to build wealth and secure your financial future. In today’s society, simply saving cash isn’t enough – inflation can quietly erode the value of money over time, so it’s essential to put your money to work in investments that outpace inflation. More people than ever are turning to investing as a way to grow their wealth and achieve long-term goals. Whether you’re saving for a home, planning for retirement, or just wanting to make your money work harder, investing can help you reach those goals faster. Over the long run, well-chosen investments (like shares or ETFs) can earn returns that keep you ahead of rising living costs.

If you’re a beginner looking to start investing, Tiger Trade is a trading and investing app offered by Tiger Brokers that lets you buy and sell a wide range of investments right from your phone or computer. Think of it as your all-in-one investment toolkit where you can trade:

All in one place. The platform is designed to be intuitive for newcomers while still offering advanced features as you grow more experienced.

*New clients & unfunded existing clients only. Min. brokerage for 4 AU/US/options trades & added spread for exchanging $2,000 AUD waived per month. Other fees and T&Cs apply.

**Cumulative net deposit=Cumulative deposit amount - Cumulative withdrawal amount, Withdrawing trading profits does not count in the calculation of the cumulative net deposit.

Tiger Trade isn’t just an ordinary brokerage app – it comes packed with award-winning features that are especially useful for newcomers learning the ropes. Here are some key beginner-friendly features that will make your investing journey easier:

With these award-winning features, Tiger Trade not only makes investing accessible but also helps you avoid mistakes by keeping you informed and equipped with tools. And speaking of mistakes – let’s look at a few common errors new investors make and how to steer clear of them.

❌ Paying high fees – Overtrading on high-fee brokers or paying unnecessary account fees means less money compounding for you. Tiger offers competitive, low-cost trading (and free trades for new users!).

❌ Lack of diversification – “Don’t put all your eggs in one basket.” A common rookie mistake is to invest only in one stock or one type of asset. Some platforms only offer one or a few securities – with Tiger Trade, you get access to multiple markets and asset classes (ASX, US, HK stocks, ETFs, and more), so you can easily spread your investments around.

❌ Lack of educational resources – Some beginners dive into trading stocks without fully understanding what they’re doing – perhaps chasing hot tips or trending “meme” stocks blindly. Tiger Trade’s platform is built to educate. From the Tiger Academy tutorials to the TigerGPT AI assistant that can break down financial info, you have resources to research any investment before you buy.

Here’s one of the best parts about starting with Tiger Trade: new customers get an incredibly generous “zero-fee” welcome package that makes your initial investing essentially cost-free. Tiger Brokers currently offers the following incentives to new clients (including beginners signing up via WeMoney):

✅ 4x Zero Brokerage Trades*

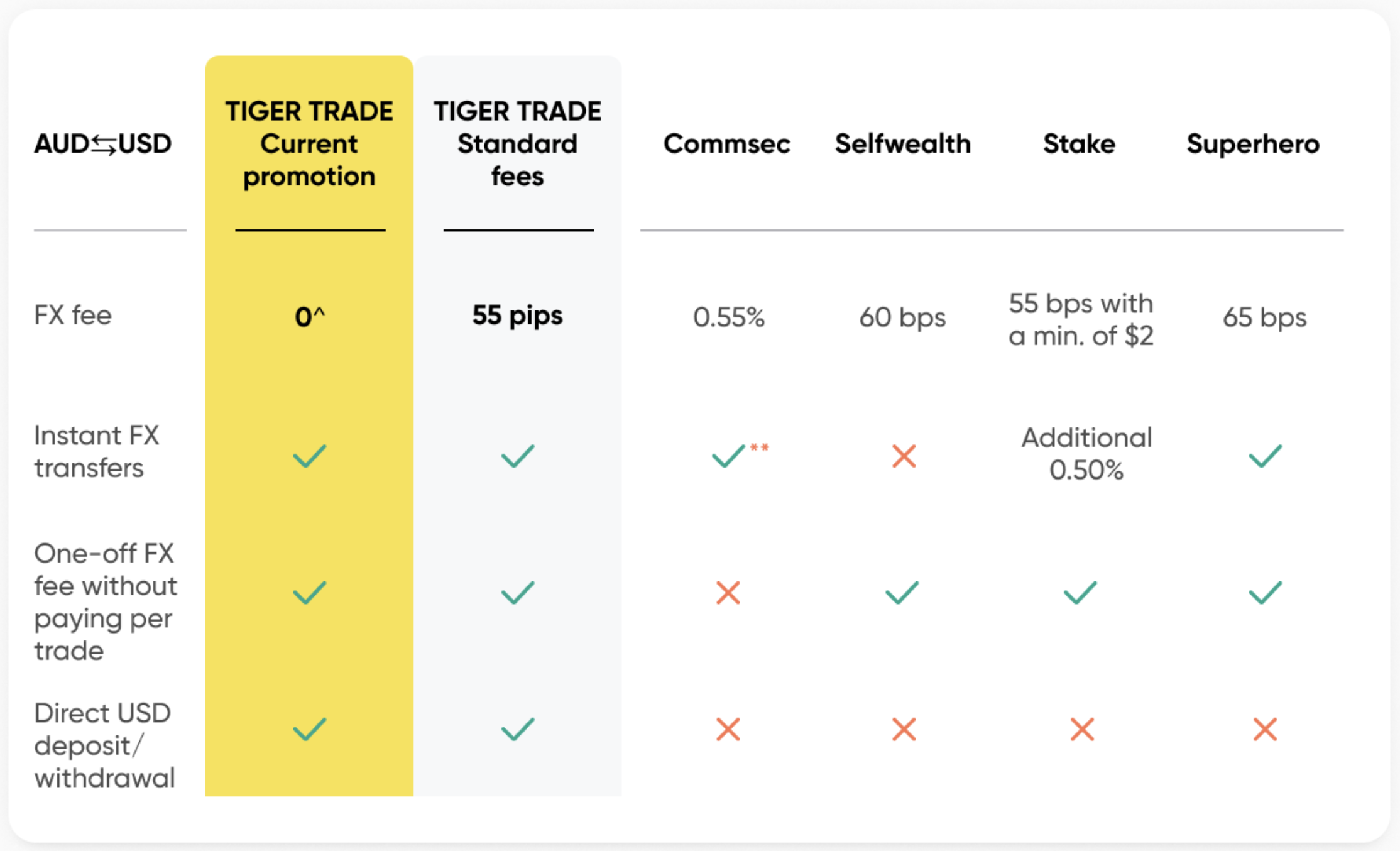

✅ Zero FX Fees on Currency Exchange (up to AUD $2,000/month)**

✅ AUD $20 Cash Voucher^ on First Deposit

✅ Exclusive $40 Bonus if you sign up to Tiger Trade through WeMoney and deposit $2,000 or more

Putting it together – an example: Imagine you download Tiger Trade and deposit $500 to start investing. You decide to set up an auto-invest plan to buy $100 of a U.S. stock (say, Tesla) each month. With Tiger’s welcome incentives, your first few auto-invest purchases can be done completely fee-free – you’ll pay no brokerage on those trades and no FX fee on converting that $100 into USD (since it’s within the $2,000 monthly free FX limit). Essentially, you’re buying stock with 100% of your money going into the investment, not lost to fees. Over a year, if you invested $1,200 this way, Tiger’s zero-fee incentive could easily save you dozens of dollars in fees compared to other brokers. That’s money that stays invested and can compound for your future.

There’s no better time to start investing than now. Every day you wait is a day your money could be growing for you. With Tiger Trade’s beginner-friendly platform and the welcome rewards on offer, you can easily begin your investing journey with guidance and virtually no costs. So why not take that first step?

Sign up for Tiger Trade through our special WeMoney link and claim your welcome bonuses. In just a few minutes, you can set up your account, get your free trades and cash rewards, and make your first investment toward a brighter financial future.

Terms

*Only min. brokerage waived for 4 ASX, US stocks or options trades. 3rd party and other fees still apply. **0 added spread and for AUD USD only. Pass-through bid-ask spread still apply. ^withdrawal restrictions apply. See pricing page and T&Cs. Capital at risk. AFSL 300767.